- The Brief

- Posts

- Navigating Uncertainty: The Case for Strong, Disciplined Businesses

Navigating Uncertainty: The Case for Strong, Disciplined Businesses

Decode the most important shifts in India's consumer economy with Lightbox

☕🗞️ Good morning! Welcome to The Brief, Edition #10

Discipline is the key to resilience and success. Image credit: Lightbox

In this week’s edition we assess how the sharp decline in India’s private equity and venture capital dealmaking will impact sentiment over the next few quarters; what the IPO momentum looks like for new age companies; and, of course, a rundown of the most interesting news and developments from the consumer economy.

Before we dive in, a quick introduction to who we are.

Lightbox is a Mumbai-born venture capital firm focused on technology-led consumer businesses. Over the past decade we’ve employed a concentrated portfolio construction and deep operational engagement to enable our portfolio companies and limited partners to navigate this market.

India is moving steadily towards becoming a $10 trillion economy, driven by rising consumption and digital adoption. We believe we are uniquely positioned to offer a front-row seat to the most important shifts in the country’s consumer markets. If you’re a global capital allocator, family office, UHNI, or strategic investor looking to participate in the India opportunity—this newsletter is for you.

Let’s get into it.

📡 Signals

Momentum Slows. Good Businesses Don’t.

Uncertainty is a constant in the venture capital business, and the latest disruption has come in the form of escalating global trade wars. Since April, the “Liberation Day” tariffs announced by the US have cast a long shadow over private equity and venture capital (PE-VC) dealmaking, slowing the early momentum seen at the start of the year. In India, both investments and exits were significantly impacted by the end of the second quarter of 2025.

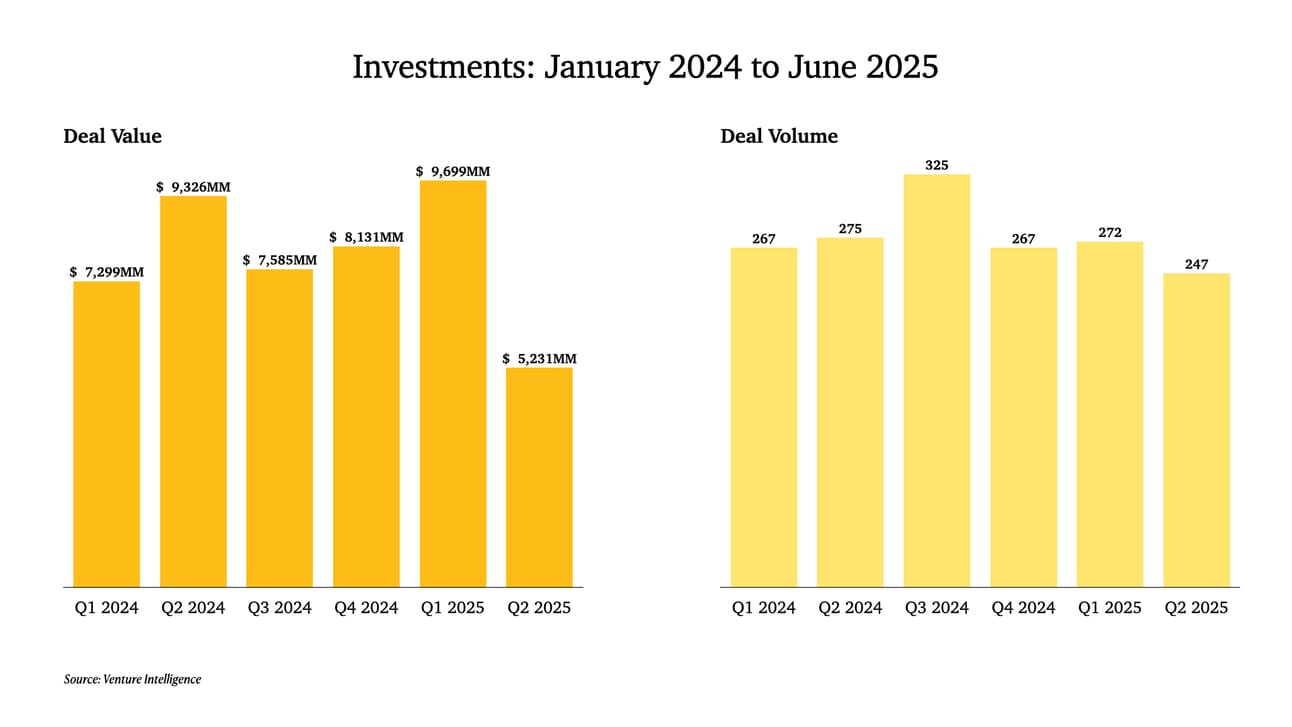

Investments fell 46% in Q2 CY2025 to $5.2 billion, down from $9.7 billion in Q1. On a year-on-year basis, investments for the first half of CY2025 declined 10.2% to $14.9 billion compared to the same period in CY2024.

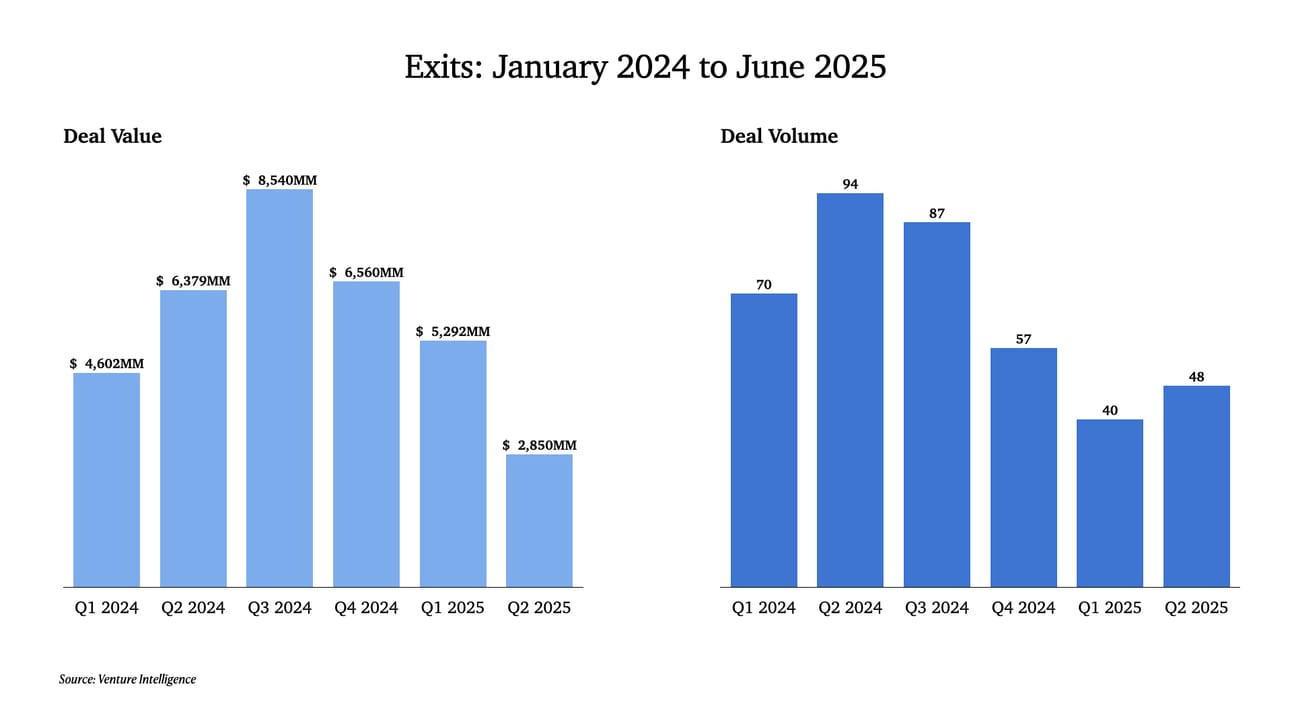

Exits were also hit hard. From 40 exit transactions worth $5.3 billion in Q1 CY2025, the second quarter recorded 48 exits amounting to just $2.8 billion. Year-on-year, exit values for the first half of 2025 dropped nearly 26% from the corresponding period last year. The number of deals fell from 164 to 88.

The Indian market’s slowdown reflects global trends. Bain & Co’s “Private Equity Midyear Report 2025” noted that dealmaking lost steam in the second quarter, stating: “With little prospect of the world returning to its pre-April 2 certainties, even if recent tariffs remain fully or partially rolled back, tomorrow’s winners will be those that can also gauge the long-term ability of companies to adjust to a new, post-globalized era.”

With the 90-day pause on the “Liberation Day” tariffs set to end on July 9, negotiations between India and the US are underway to reduce the impact of the tariffs. Regardless of the outcome, with sentiment already weakened, it may take a few more quarters for deal activity to recover.

A couple of weeks ago, we shared updates on the strong gains made across the Lightbox portfolio over the past six months, driven by the deep engagement we undertook to help our companies navigate one of the toughest downturns the startup ecosystem has seen. The green shoots of recovery have been visible since early 2025, and today we are well-positioned to keep building differentiated, category-defining businesses that deliver strong returns to our investors.

Uncertainties will come and go, but good businesses will always find higher ground.

IPO Ambitions Persist Despite Exit Headwinds

The public markets have been volatile this year and the M&A landscape lacks the depth needed to support the scale of exits PE-VC investors require to deliver meaningful returns. Fewer PE-VC-backed companies have gone public in 2025 but several businesses continue to factor the public markets into their medium-term fundraising strategies.

Rentomojo, the furniture rental platform, is preparing for an IPO in FY27 following a return to profitable growth. It posted a profit of ₹4.5 crore in FY24, reversing losses from the previous year, with revenues rising 43% to ₹145 crore. Curefoods, which runs cloud kitchens and digital-first restaurant brands, has filed for a ₹800 crore IPO. It reported ₹585 crore in revenues and ₹173 crore in losses in FY24.

Earlier, fintechs Pine Labs and Groww announced IPO plans. Pine Labs is targeting a ₹5,000–6,000 crore raise, while Groww is expected to raise between $700 million and $1 billion, per media reports.

According to The Economic Times, PE-VC backed companies are estimated to raise over ₹18,000 crore (more than $2 billion) from IPOs this year.

📰 News

TR Capital’s Latest Secondary; Reliance Consolidates FMCG

Reliance Industries to consolidate FMCG brands under new entity

Reliance Industries has initiated moves to consolidate its FMCG businesses under a new subsidiary dubbed Reliance Consumer Products. Currently the FMCG businesses are managed by three entities — Reliance Retail, Reliance Retail Ventures and Reliance Consumer Products. According to reports, the FMCG businesses are currently valued at Rs 11,500 crore (FY25) and includes brands such as Campa Cola, SIL and Velvette.

TR Capital snaps up MoEngage, Shadowfax and Whatfix in latest secondary

Secondaries-focused private equity firm TR Capital has acquired stakes in MoEngage, Shadowfax and Whatfix from Eight Roads Ventures in a $50-million transaction. Eight Roads first invested in Shadowfax, Moengage and Whatfix in 2015, 2020 and 2019 respectively. TR Capital has increased its focus on India since 2008. In 2023, it acquired Samara Capital’s stakes in Sahajanand Medical Technologies, First Meridian Business Services, and Paradise Food Court in a $150-million secondary deal.

Apollo Hospitals to list omni-channel pharmacy and digital health business

The Apollo Hospitals board has approved the separate listing of its omni-channel pharmacy and digital health business within 18-21 months, as part of a broader reorganisation to unlock value. Apollo Hospitals will demerge its pharmacy and Apollo 24x7 digital health units into a standalone company, which will also absorb Apollo HealthCo and pharma wholesaler Keimed. The combined entity is projecting revenues for FY26 at Rs 16,300 crore and Rs 25,000 crore in FY27, reports said.

Peak XV checks into fertility clinics

Luma Fertility, a company that operates full-stack fertility clinics in Mumbai, has raised $4 million in a round led by Peak XV’s Surge platform. Founded a year ago, the company has a 6,000 square feet clinic and plans to expand to Bangalore, Hyderabad, Pune and Delhi. India’s fertility services market is expected to grow to over $4 billion by 2033 according to IMARC Group.

Wipro venture arm targets mature consumer bets

Wipro Consumer Care Ventures is shifting its investment approach to more mature consumer startups. It will now concentrate on pre-Series A and Series A rounds. Against sub-Rs 10 crore deals, the firm will now invest up to ₹10-25 crore while limiting its shareholding to 20%, reports said.

We would love to hear from you. Please reply to this email with your thoughts, suggestions, or just to say hello. If you would like to share this newsletter with colleagues, associates and friends in the ecosystem, point them to the Subscribe button below.